Risk Management: Foundations for a Changing Financial World[风险管理]

¥ 380 4.0折 ¥ 959.1 九品

仅1件

送至北京市朝阳区

运费快递 ¥6.00

作者Walter V. Bud Haslett 编

出版社Wiley

出版时间2010-09

版次1

装帧精装

上书时间2024-12-22

评价137好评率 100%

- 最新上架

商品详情

- 品相描述:九品

图书标准信息

- 作者 Walter V. Bud Haslett 编

- 出版社 Wiley

- 出版时间 2010-09

- 版次 1

- ISBN 9780470903391

- 定价 959.10元

- 装帧 精装

- 开本 16开

- 纸张 胶版纸

- 页数 797页

- 正文语种 英语

- 丛书 CFA Institute Investment Perspectives

- 【内容简介】

-

Riskmanagementmayhavebeenthesinglemostimportanttopicinfinanceoverthepasttwodecades.Toappreciateitscomplexity,onemustunderstandtheartaswellasthesciencebehindit.RiskManagement:FoundationsforaChangingFinancialWorldprovidesinvestmentprofessionalswithasolidframeworkforunderstandingthetheory,philosophy,anddevelopmentofthepracticeofriskmanagementby

Outliningtheevolutionofriskmanagementandhowthedisciplinehasadaptedtoaddressthefutureofmanagingrisk

Coveringthefullrangeofriskmanagementissues,includingfirm,portfolio,andcreditriskmanagement

Examiningthevariousaspectsofmeasuringriskandthepracticalaspectsofmanagingrisk

Includingkeywritingsfromleadingriskmanagementpractitionersandacademics,suchasAndrewLo,RobertMerton,JohnBogle,andRichardBookstaber

Forfinancialanalysts,moneymanagers,andothersinthefinanceindustry,thisbookoffersanin-depthunderstandingofthecriticaltopicsandissuesinriskmanagementthataremostimportanttotoday'sinvestmentprofessionals. - 【作者简介】

- WalterV."Bud"HaslettJr.,CFA,isHead,RiskManagement,Derivatives,andAlternativeInvestmentsforCFAInstitute.Mr.HasletthasservedCFAInstituteasanexamgraderandmemberoftheCouncilofExaminersaswellasanadhocreviewerfortheFinancialAnalystsJournalandabstractorfortheCFADigest.HeispastpresidentoftheCFASocietyofPhiladelphiaandformerboardmemberoftheNewYorkSocietyofSecurityAnalysts.HeholdsaMasterofLiberalArtsfromtheUniversityofPennsylvaniaandanMBAfromDrexelUniversity.PriortojoiningCFAInstitute,Mr.HaslettwasheadofoptionanalyticsforMillerTabak&Co.,LLC,andspentmuchofhiscareermanagingriskontheoptiontradingfloorsatthePhiladelphiaStockExchange.

- 【目录】

-

Foreword.

Acknowledgments.

Introduction.

PART I: OVERVIEW—TWO DECADES OF RISK MANAGEMENT.1990–1999.

CHAPTER 1: A Framework for Understanding Market Crisis (Richard M.Bookstaber)

Reprinted from AIMR Conference Proceedings: Risk Management:Principles and Practices (August 1999):7–19.

CHAPTER 2: Practical Issues in Choosing and Applying RiskManagement Tools (Jacques Longerstaey)

Reprinted from AIMR Conference Proceedings: Risk Management:Principles and Practices (August 1999):52–61.

CHAPTER 3: The Three P's of Total Risk Management (Andrew W.Lo)

Reprinted from the Financial Analysts Journal (January/February1999):13–26.

CHAPTER 4: Reporting and Monitoring Risk Exposure (Robert W.Kopprasch, CFA)

Reprinted from AIMR Conference Proceedings: Risk Management(April 1996): 25–33.2000–Present.

CHAPTER 5: Risk Management: A Review (Sébastien Lleo, CFA)

Modifi ed from The Research Foundation of CFA Institute (February2009).

CHAPTER 6: Defining Risk (Glyn A. Holton)

Reprinted from the Financial Analysts Journal (November/December2004): 19–25.

CHAPTER 7: Value and Risk: Beyond Betas (Aswath Damodaran)

Reprinted from the Financial Analysts Journal (March/April2005):38–43.

CHAPTER 8: A Simple Theory of the Financial Crisis; or, WhyFischer Black Still Matters (Tyler Cowen)

Reprinted from the Financial Analysts Journal (May/June2009):17–20.

CHAPTER 9: Managing Firm Risk (Bluford H. Putnam)

Reprinted from AIMR Conference Proceedings: Ethical Issues forToday’s Firm (July 2000):51–61.

CHAPTER 10: Risk Measurement versus Risk Management (D. SykesWilford)

Reprinted from AIMR Conference Proceedings: Improving theInvestment Process through Risk Management (November2003):17–21.

PART II: MEASURING RISK.

CHAPTER 11: What Volatility Tells Us about Diversifi cation andRisk Management (Max Darnell)

Reprinted from CFA Institute Conference Proceedings Quarterly(September 2009):57–66.

CHAPTER 12: Risk2: Measuring the Risk in Value at Risk (PhilippeJorion)

Reprinted from the Financial Analysts Journal (November/December1996): 47–56.

CHAPTER 13: How Risk Management Can Benefi t Portfolio Managers(Michelle McCarthy)

Reprinted from AIMR Conference Proceedings: Risk Management:Principles and Practices (August 1999):62–72.

CHAPTER 14: Merging the Risk Management Objectives of the Clientand Investment Manager (Bennett W. Golub)

Reprinted from AIMR Conference Proceedings: Exploring theDimensions of Fixed-Income Management (March 2004):13–23.

CHAPTER 15: The Mismeasurement of Risk (Mark Kritzman, CFA, andDon Rich)

Reprinted from the Financial Analysts Journal (May/June2002):91–99.

CHAPTER 16: Riskiness in Risk Measurement (Roland Lochoff)

Reprinted from AIMR Conference Proceedings: Exploring theDimensions of Fixed-Income Management (March 2004):40–51.

CHAPTER 17: The Second Moment (Don Ezra)

Reprinted from the Financial Analysts Journal (January/February2009): 34–36.

CHAPTER 18: The Sense and Nonsense of Risk Budgeting (Arjan B.Berkelaar, CFA, Adam Kobor, CFA, and Masaki Tsumagari, CFA)

Reprinted from the Financial Analysts Journal (September/October2006): 63–75.

CHAPTER 19: Understanding and Monitoring the Liquidity CrisisCycle (Richard Bookstaber)

Reprinted from the Financial Analysts Journal (September/October2000):17–22.

CHAPTER 20: Why Company-Specifi c Risk Changes over Time (James A.Bennett, CFA, and Richard W. Sias)

Reprinted from the Financial Analysts Journal (September/October2006): 89–100.

CHAPTER 21: Black Monday and Black Swans (John C. Bogle)

Reprinted from the Financial Analysts Journal (March/April2008):30–40.

CHAPTER 22: The Uncorrelated Return Myth (Richard M. Ennis,CFA)

Reprinted from the Financial Analysts Journal (November/December2009):6–7.

PART III: MANAGING RISK.

Alternative Investments.

CHAPTER 23: Risk Management for Hedge Funds: Introduction andOverview (Andrew W. Lo)

Reprinted from the Financial Analysts Journal (November/December2001): 16–33.

CHAPTER 24: Risk Management for Alternative Investment Strategies(Leslie Rahl)

Reprinted from AIMR Conference Proceedings: Exploring theDimensions of Fixed-Income Management (March 2004):52–62.

CHAPTER 25: Sources of Change and Risk for Hedge Funds (CliffordS. Asness)

Reprinted from CFA Institute Conference Proceedings: Challengesand Innovation in Hedge Fund Management (August 2004):4–9,13–14.

CHAPTER 26: Risk Management in a Fund of Funds (S. LukeEllis)

Reprinted from CFA Institute Conference Proceedings: Challengesand Innovation in Hedge Fund Management (August 2004):31–39.

CHAPTER 27: Hedge Funds: Risk and Return (Burton G. Malkiel andAtanu Saha)

Reprinted from the Financial Analysts Journal (November/December2005): 80–88.

Credit Risk.

CHAPTER 28: Credit Risk (Jeremy Graveline and MichaelKokalari)

Modifi ed from The Research Foundation of CFA Institute (November2006).

CHAPTER 29: Tumbling Tower of Babel: Subprime Securitization andthe Credit Crisis (Bruce I. Jacobs)

Reprinted from the Financial Analysts Journal (March/April2009):17–30.

CHAPTER 30: Applying Modern Risk Management to Equity and CreditAnalysis (Robert C. Merton)

Reprinted from CFA Institute Conference Proceedings Quarterly(December 2007):14–22.

Derivatives.

CHAPTER 31: The Uses and Risks of Derivatives (Joanne M.Hill)

Reprinted from AIMR Conference Proceedings: Investing WorldwideVI (January 1996):46–58.

CHAPTER 32: Effective Risk Management in the Investment Firm (MarkC. Brickell)

Reprinted from AIMR Conference Proceedings: Risk Management(April 1996):48–55.

CHAPTER 33: Risk-Management Programs (Maarten Nederlof)

Reprinted from AIMR Conference Proceedings: Risk Management(April 1996):15–24.

CHAPTER 34: Does Risk Management Add Value? (Charles W.Smithson)

Reprinted from AIMR Conference Proceedings: Corporate FinancialDecision Making and Equity Analysis (July 1995):47–53.

CHAPTER 35: Risk Management and Fiduciary Duties (Robert M.McLaughlin)

Reprinted from AIMR Conference Proceedings: Risk Management:Principles and Practices (August 1999):20–31.

Global Risk.

CHAPTER 36: Financial Risk Management in Global Portfolios (R.Charles Tschampion, CFA)

Reprinted from AIMR Conference Proceedings: Investing WorldwideVI (January 1996):67–73.

CHAPTER 37: Universal Hedging: Optimizing Currency Risk and Rewardin International Equity Portfolios (Fischer Black)

Reprinted from the Financial Analysts Journal (July/August1989):16–22.

CHAPTER 38: Strategies for Hedging (Mark P. Kritzman, CFA)

Reprinted from AIMR Conference Proceedings: Managing CurrencyRisk (November 1997):28–38.

CHAPTER 39: Currency Risk Management in Emerging Markets (H.Gifford Fong)

Reprinted from AIMR Conference Proceedings: Investing WorldwideVII (September 1996):18–23.

CHAPTER 40: Managing Geopolitical Risks (Marvin Zonis)

Reprinted from CFA Institute Conference Proceedings Quarterly(September 2009):22–29.

CHAPTER 41: Country Risk in Global Financial Management (Claude B.Erb, CFA, Campbell R. Harvey, and Tadas E. Viskanta)

Reprinted from The Research Foundation of CFA Institute (January1998).

CHAPTER 42: Political Risk in the World Economies (MarvinZonis)

Reprinted from AIMR Conference Proceedings: Investing WorldwideVIII: Developments in Global Portfolio Management (September1997):1–6.

Nonfi nancial Risk.

CHAPTER 43: A Behavioral Perspective on Risk Management (Andrew W.Lo)

Reprinted from AIMR Conference Proceedings: Risk Management:Principles and Practices (August 1999):32–37.

CHAPTER 44: Behavioral Risk: Anecdotes and Disturbing Evidence(Arnold S. Wood)

Reprinted from AIMR Conference Proceedings: Investing WorldwideVI (January 1996):74–78.

CHAPTER 45: The Ten Commandments of Operational Due Diligence(Robert P. Swan III)

Reprinted from CFA Institute Conference Proceedings: Challengesand Innovation in Hedge Fund Management (August 2004):47–52.

CHAPTER 46: Models (Emanuel Derman)

Reprinted from the Financial Analysts Journal (January/February2009):28–33.

CHAPTER 47: The Use and Misuse of Models in Investment Management(Douglas T. Breeden)

Reprinted from CFA Institute Conference Proceedings Quarterly(December 2009): 36–45.

CHAPTER 48: Regulating Financial Markets: Protecting Us fromOurselves and Others (Meir Statman)

Reprinted from the Financial Analysts Journal (May/June2009):22–31.

Pension Risk.

CHAPTER 49: Budgeting and Monitoring Pension Fund Risk (William F.Sharpe)

Reprinted from the Financial Analysts Journal (September/October2002):74–86.

CHAPTER 50: The Plan Sponsor's Perspective on Risk ManagementPrograms (Desmond M...

为你推荐

顺兴和斋珍藏:当代书画大师范曾

八五品成都

¥428.00

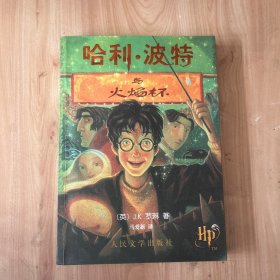

哈利波特与火焰杯 不是一版一印 有正版水印 淡绿纸

八五品北京

¥30.00

作战辅助决策理论及应用(全2册)

九五品成都

¥18.93

中国书法大字典

八五品衡水

¥60.00

人民文学2008版金瓶梅词话(上下)第2印、吉林大学出版社皋鹤堂批评第一奇书金瓶梅(上下)1994年第1印东中华路29号真版,非后翻印的明德路3号版、齐鲁书社张竹坡批评金瓶梅(上下)定价40元版。三套六本合售均有删减,确保正版,一次性集齐大陆三大经典版本,品好均为未翻阅状态,自然旧微瑕见图无修补收藏就藏正品好品,莫错过!详情看详情描述!

九五品北京

¥2180.00

易经变化原理,介意勿拍

九五品盘锦

¥23.00

中国共产党第九次全国代表大会光辉文献

八品株洲

¥59.99

中国国家地理选美中国特辑 2005年增刊

八五品深圳

¥13.80

《七龙珠》漫画 中少出版社 1-42卷仅拆封 全套 正版 旧版 绝版

九五品德州

¥620.00

围城1980版

全新聊城

¥1200.00

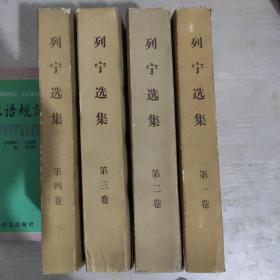

列宁选集全四卷

八五品贵阳

¥16.00

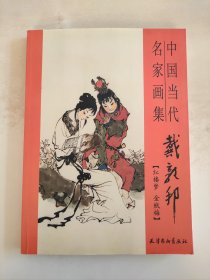

中国当代名家画集 戴敦邦 红楼梦 金瓶梅

九品哈尔滨

¥280.00

毛泽东选集 合订一卷本 封面凹凸烫金头像 (带塑料外套,纸盒)

九品大理

¥1999.00

罕见1970年红塑壳《林副主席论战术思想与战斗作风》内有两幅毛主席彩色插图(其中有一幅带林副主席)最高指示 、不缺页-尊C-4(7788)

八品成都

¥420.00

概率论及其应用(卷1•第3版)(封底右下角有磨损)邮包

七品天津

¥8.00

价值千元以上,因需要还房贷忍痛出手,绝版收藏,外国早期烟卡一本,文艺复兴法国大革命时期名人绘画为主题,170余枚(烟卡是粘贴在书上的)

八五品威海

¥1999.00

我的前半生

八五品长春

¥79.00

刺青(限时亲笔签名本)

全新上海

¥18.00

红旗飘飘17

八品深圳

¥3.00

金丹大道入门:伍柳仙踪及其要旨

九品昆明

¥120.00

— 没有更多了 —

微信扫码逛孔网

无需下载

![Risk Management: Foundations for a Changing Financial World[风险管理]](https://www0.kfzimg.com/sw/kfz-cos/kfzimg/adbecdca/328f116739356eff_b.jpg)

![Risk Management: Foundations for a Changing Financial World[风险管理]](https://www0.kfzimg.com/sw/kfz-cos/kfzimg/cfabeddc/a63d05bbe3183824_b.jpg)

![Risk Management: Foundations for a Changing Financial World[风险管理]](https://www0.kfzimg.com/sw/kfz-cos/kfzimg/febeceec/0dab449b2a92fb21_b.jpg)

![Risk Management: Foundations for a Changing Financial World[风险管理]](https://www0.kfzimg.com/sw/kfz-cos/kfzimg/babdddbe/f4f33bdfdd6a034d_b.jpg)

![Risk Management: Foundations for a Changing Financial World[风险管理]](https://www0.kfzimg.com/sw/kfz-cos/kfzimg/bfceabaf/5c1b7ffddb04b397_b.jpg)

![Risk Management: Foundations for a Changing Financial World[风险管理]](https://www0.kfzimg.com/sw/kfz-cos/kfzimg/eecfddae/9cedd7299a829e1d_b.jpg)

![Risk Management: Foundations for a Changing Financial World[风险管理]](https://www0.kfzimg.com/sw/kfz-cos/kfzimg/babacabf/14b6a559d9f0ca33_b.jpg)

![Risk Management: Foundations for a Changing Financial World[风险管理]](https://www0.kfzimg.com/sw/kfz-cos/kfzimg/ddbddefb/9dc417e9afd8a602_b.jpg)

![Risk Management: Foundations for a Changing Financial World[风险管理]](/dist/img/error.jpg)

包装相当好,书质量不错

包装好,品相好。